Tired of watching your bank account shrink faster than a TikTok trend? We've got you covered! This list of 18 apps can help you save money on everything from groceries to your monthly bills. Whether you're looking for cashback rewards, budgeting tools, or just a way to keep track of your spending, there's an app here for you.

We've tested out tons of money-saving apps and narrowed it down to the best of the best. Chime is a fantastic option for banking and earning cash back, Ibotta is your go-to for saving on groceries and everyday purchases, and Money Manager Expense & Budget will help you track your spending like a pro. Get ready to unlock your inner financial guru and start saving today!

| App | Logo | Available On | Reviews | Downloads | Features |

|---|---|---|---|---|---|

| 1. Chime |  | Android, iOS | 4.8/5 | 25M+ | Overdraft up to $200, No monthly fees, Get paid early |

| 2. Ibotta |  | Android, iOS | 4.8/5 | 22M+ | Real cash back, not points, In-store and online savings |

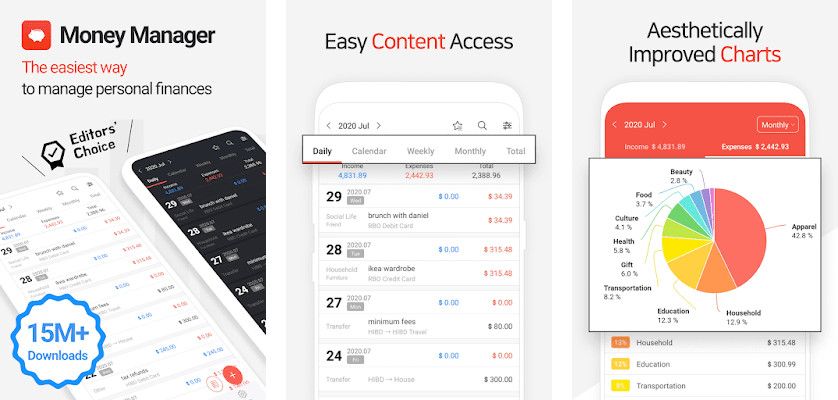

| 3. Money Manager Expense & Budget |  | Android, iOS | 4.8/5 | 18M+ | Double entry accounting, Budget and expense management |

| 4. Acorns |  | Android, iOS | 4.8/5 | 11M+ | Automatic micro-investing, Round-ups to the nearest dollar |

| 5. Rocket Money |  | Android, iOS | 4.3/5 | 9M+ | Track net worth, Cancel subscriptions, Negotiate lower bills |

| 6. Money Lover |  | Android, iOS | 4.6/5 | 8M+ | Expense Tracking, Budget Planning, Sync Across Devices |

| 7. SoFi |  | Android, iOS | 4.8/5 | 4M+ | Up to $1000 in free stock, Earn up to 4.60% APY, Invest in popular financial assets |

1. Chime

No monthly fees, Fee-free overdraft protection, Get paid early

Download:

Application information

| Category | Finance |

| Downloads | Over 25 million downloads |

| Features | Chime is a free, no-fee banking app that helps you save money with features like early direct deposit, fee-free overdraft, and spending insights. |

| Who It’s For | People looking for an app for saving money and managing their finances without monthly fees. |

- Tags:

- Overdraft up to $200 fee-free

- Get paid up to 2 days early

- No monthly fees‡

Chime is a popular mobile app designed to help users save money, offering features like automatic savings and early access to paychecks. While users praise the app's helpful features, like "spot me" for overdraft protection and early pay, some find the recent design updates frustrating and have encountered issues with app responsiveness. While the app's core functionality for managing finances remains strong, users are eager for improvements that address the technical glitches and provide a smoother user experience, particularly when it comes to sending money to friends and navigating the app's various features.

Pros & Cons

- Automatic saving features

- Early payday access

- Fee-free overdraft protection

- Spot Me feature for emergencies

- New app design is bad

- App can be unresponsive

- No option to decline debit card

Why we chose it?

I love Chime for its no-fee banking and early direct deposit features. It helps me save money on monthly fees and even get paid early, which is awesome for budgeting! Plus, the free overdraft protection is a lifesaver for those unexpected expenses.

✨ Read more: app to buy crypto

2. Ibotta

Earn cash back on purchases, Redeem offers before shopping, Deposit directly to bank account

Download:

Application information

| Category | Shopping |

| Downloads | Over 21 million downloads |

| Features | Ibotta offers cash back on groceries, household goods, electronics, and more, with easy-to-use features like barcode scanning, personalized offers, and the ability to earn extra cash back through referrals. |

| Who It’s For | Anyone looking for an app for saving money on everyday purchases. |

- Tags:

- Real Cash Back

- Easy to use

- Wide Variety of Offers

Ibotta is a popular app for saving money that allows users to earn cash back on everyday purchases. While users appreciate the potential for significant savings (with some reporting earning over $256 per year), frustration arises when the app encounters glitches, preventing users from clipping deals and taking advantage of the savings. The app's success hinges on users coordinating their shopping trips with available offers, and some find limitations with clearance items or the requirement to buy larger quantities to qualify for cash back. However, users who find suitable offers and manage their shopping accordingly praise the app's quick and easy payout system, making Ibotta a valuable tool for budget-conscious shoppers.

Pros & Cons

- Offers cash back on purchases

- Easy to use and navigate

- Fast and easy payouts

- Can save money on groceries

- App can be glitchy and crash

- Limited offers available at times

- Requires bulk purchases for deals

Why we chose it?

I'm a huge fan of Ibotta! It's super easy to use, and I love that you can earn real cash back on everyday purchases. No points or complicated programs, just simple cash back that you can deposit straight to your bank account or redeem for gift cards. Ibotta is my go-to app for saving money, especially on groceries and household items.

✨ Read more: app to borrow money

3. Money Manager Expense & Budget

Track spending and income, Create detailed budgets, Analyze financial trends

Cost:

Free (Free), Premium ($4.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 17 million downloads |

| Features | Money Manager provides budgeting, expense tracking, and financial planning tools for managing personal and business finances effectively. |

| Who It’s For | Individuals and businesses looking for an app for saving money through effective budgeting and expense tracking. |

- Tags:

- Double-entry bookkeeping

- Budget and expense manager

- Personal asset management

If you're looking for an app that helps you take control of your finances and actually save money, Money Manager Expense & Budget is a game-changer. Users rave about its user-friendliness, making budgeting and tracking expenses a breeze. The app allows you to categorize spending, visualize your income and expenses over time, and even create detailed budgets for specific categories. One user even said it was "significantly better than the other finance apps available," highlighting its intuitive design and robust features. And the best part? The free version offers a wealth of features with minimal ads, so you can start managing your money smarter without breaking the bank.

Pros & Cons

- User friendly and easy setup

- Great for budgeting and tracking

- Detailed income and expense analysis

- Affordable upgrade with valuable features

- Difficult to input historical data

- Limited functionality in PC editor

- Lacks combined income/expense graphs

Why we chose it?

I've tried a ton of budgeting apps, but Money Manager really stands out! It's super easy to use, even for someone like me who's not a financial expert. Plus, it helps me track every penny, so I can see exactly where my money is going and find those sneaky little expenses that add up. It's been a game-changer for my savings goals, and I definitely recommend it!

✨ Read more: app for budgeting

4. Acorns

Round up purchases to invest, Automated investing with ETFs, Diversified portfolio options

Download:

Application information

| Category | Finance |

| Downloads | Over 11 million downloads |

| Features | Acorns automatically invests your spare change, rounds up purchases, and offers diversified portfolios for long-term growth. |

| Who It’s For | People who want to save money effortlessly and build wealth over time. |

- Tags:

- Automated investing

- Round-Ups® feature

- Personalized portfolios

Acorns is a fantastic app for saving money, making it easy to set aside extra cash with every purchase. Users love its simplicity and ease of use, allowing them to automatically round up their transactions and invest those small amounts. While some users have noted that the round-up feature doesn't always sync perfectly, the ability to switch to weekly investments or even use Acorns just for short-term savings makes it a versatile tool. With its pre-selected portfolios and low fees, Acorns is an ideal choice for new investors or anyone looking to build a solid savings habit, even if it's just a few hundred dollars at a time.

Pros & Cons

- Easy to use and navigate

- Simple and quick to use

- Low fees for new investors

- Easy to set aside extra cash

- Round ups don't always sync

- Manual round ups feature removed

- Not for long term savings

Why we chose it?

I love Acorns because it makes saving effortless! With automatic round-ups and diversified investment portfolios, it's like having a financial advisor in my pocket. Plus, the user-friendly interface makes managing my money a breeze, which is perfect for someone like me who isn't a financial expert.

✨ Read more: app to make money

5. Rocket Money

Cancel unwanted subscriptions, Negotiate lower bills, Track spending & budget

Cost:

Free (Free), Rocket Money Premium ($12.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 8.7 million downloads |

| Features | Rocket Money helps you manage subscriptions, negotiate bills, track expenses, create budgets, and monitor your credit score. |

| Who It’s For | People looking for an app for saving money, managing finances, and avoiding unnecessary expenses. |

- Tags:

- Net worth tracking

- Subscription management

- Bill negotiation

Rocket Money is a powerful app for saving money that simplifies your financial life. With its intuitive interface, you can easily track your spending, analyze your expenses with beautiful visualizations, and categorize transactions with ease. The app even helps you identify and cancel unnecessary subscriptions, putting more money back in your pocket. While users have reported some syncing issues, the app's ability to pull past and current data, along with its user-friendly interface, make it a valuable tool for anyone looking to gain control of their finances.

Pros & Cons

- Tracks spending effectively

- Intuitive user interface

- Visualizations are helpful

- Identifies subscriptions to cancel

- Syncing issues with transactions

- Account reconnection required frequently

- Subscription cancellation feature unreliable

Why we chose it?

Rocket Money is a total game-changer for saving money! It's like having a personal finance superhero in your pocket, automatically finding and canceling unwanted subscriptions, negotiating lower bills, and helping you stay on top of your budget. I love that it's easy to use and has a ton of great features, like tracking my spending and setting up savings goals, making it the perfect app for anyone serious about taking control of their finances.

✨ Read more: app to buy stocks

6. Money Lover

Track expenses with ease, Budget and save money, Financial insights and reports

Cost:

Free (Free), Premium ($2.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 7.8 million downloads |

| Features | Money Lover helps you track your spending, create budgets, manage bills, predict future spending, and analyze your finances to help you save more money. |

| Who It’s For | Anyone looking for an app to help them save money. |

- Tags:

- Expense Tracking

- Budget Planning

- Seamless Syncing

Money Lover is a delightful app for saving money that makes budgeting feel less like a chore and more like a stylish, organized adventure. Its intuitive interface and pleasing visuals, as one user put it, make managing your finances a pleasant experience. While the app boasts features like multiple wallet management and subcategories for detailed tracking, users have highlighted a need for improvements in areas like bank statement syncing and setting budgets across accounts. Despite these minor hiccups, Money Lover remains a promising tool for anyone looking to take control of their finances with an app that's as visually appealing as it is functional.

Pros & Cons

- Easy to use/intuitive

- Multiple device syncing

- Usable free version

- Aesthetically pleasing

- No auto-syncing for US banks

- Redundant budget setting across wallets

- Bills don't sync across devices

Why we chose it?

Money Lover is my go-to app for staying on top of my finances. I love that it lets me easily track my spending and set budgets, helping me stay accountable and save more. The best part? It's incredibly user-friendly, making managing my money a breeze!

7. SoFi

High-yield savings accounts, Automated savings tools, Financial planning resources

Download:

Application information

| Category | Finance |

| Downloads | Over 3.6 million downloads |

| Features | SoFi is an app that allows you to set financial goals, save money, invest, and manage your finances from your phone. |

| Who It’s For | SoFi is for people who want to save money, invest, and manage their finances from their phone. |

- Tags:

- Up to $1000 free stock

- High-yield checking and savings

- No account fees

SoFi is a powerful app for saving money that offers a comprehensive suite of financial tools, from budgeting and spending tracking to investing and even mortgage management. While its interface can feel cluttered at times, particularly with the abundance of promotions, it provides valuable insights into your financial health. Users praise the app's robust features, particularly its ability to track accounts and spending, but desire a more streamlined experience, possibly through a minimalist mode option. Although SoFi's integration with financial institutions is generally reliable, users often express a wish for broader support, such as direct connections to mortgage companies and property value tracking through platforms like Zillow.

Pros & Cons

- Great for saving money

- Easy to track spending

- Good for financial insights

- Offers great APY on accounts

- Cluttered UI can be overwhelming

- App sometimes fails to load properly

- Limited account connection options

Why we chose it?

SoFi is a fantastic app for saving money because it combines a high-yield checking and savings account with smart budgeting tools. I love that I can easily track my spending, set goals, and even get personalized advice on how to save more. Plus, SoFi's commitment to ethical investing allows me to feel good about my money while I grow it!

8. EveryDollar

Track spending and income, Create custom zero-based budgets, Manage multiple financial accounts

Cost:

EveryDollar Basic (Free), EveryDollar Plus ($12.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 3 million downloads |

| Features | EveryDollar helps you create a budget, track expenses, plan spending, and reach financial goals, empowering you to take control of your finances. |

| Who It’s For | EveryDollar is a great app for saving money, suitable for anyone looking to manage their finances effectively. |

- Tags:

- Budget Tracking

- Expense Monitoring

- Financial Planning

EveryDollar is a popular app for saving money that helps users track their expenses, create budgets, and reach financial goals. While many users praise the app's effectiveness in managing their finances, some have experienced technical glitches and frustrations with the user interface. Despite these issues, the app has a loyal following who appreciate its ability to keep their spending in check and provide a clear picture of their financial health. Whether you're looking to tighten your belt or simply get a better handle on your money, EveryDollar offers a powerful tool for achieving your financial goals.

Pros & Cons

- Helps track spending

- Simple budgeting interface

- Free version available

- Premium version available

- Glitches and bugs

- Difficult to use

- Limited transaction tracking

Why we chose it?

EveryDollar is my go-to app for saving money because it takes the guesswork out of budgeting. It's incredibly easy to set up, with clear categories and helpful tools that make tracking my spending a breeze. Plus, the zero-based budgeting approach helps me prioritize what's important and stay on track with my financial goals, ensuring I'm always in control of my money!

9. YNAB

Budgeting based on your income, Track every dollar you spend

Cost:

YNAB (Free Trial) (Free for 34 days), YNAB (Paid) ($14.99 per month (annual subscription))

Download:

Application information

| Category | Finance |

| Downloads | Over 2.5 million downloads |

| Features | YNAB helps you track your income and expenses, budget your money, and reach your financial goals. |

| Who It’s For | People who want to take control of their finances, save money, and achieve their financial goals. |

- Tags:

- Budgeting Simplified

- Easy Spending Tracking

- Debt Reduction Tools

YNAB is a game-changing app for saving money, taking a fresh approach to budgeting that focuses on what you actually have, not just tracking where it goes. Users rave about its ability to help them accurately pay bills, plan for surprises, and even save for big goals – all within just a couple of months. While some users wish for a more robust mobile app experience, the overall sentiment is positive, highlighting YNAB's power to transform financial habits and empower users to take control of their money.

Pros & Cons

- Helps accurately pay bills

- Plan for unexpected expenses

- Game changer for saving

- Deals with actual money

- App not as robust

- Mediocre execution of concept

- Behind the times on features

Why we chose it?

I absolutely love YNAB! It's the only app that's helped me truly understand where my money goes and how to make it work for me. YNAB's zero-based budgeting system is a game-changer, forcing you to be mindful of every dollar. Plus, it's super intuitive and user-friendly, so even a budgeting newbie like me can master it!

10. Oportun

Learns spending habits, Saves personalized amounts, Sets savings goals

Download:

Application information

| Category | Finance |

| Downloads | Over 2.3 million downloads |

| Features | Oportun helps you build savings with personalized amounts, set goals, track your progress, and manage existing loans and credit cards. |

| Who It’s For | People looking for an app for saving money, managing their finances, and building credit. |

- Tags:

- Personalized savings goals

- Rainy Day Fund savings

- Automatic savings transfers

Oportun is a powerful app for saving money that takes a unique approach, making it effortless to reach your financial goals. It learns your spending habits and automatically sets aside personalized amounts, helping you save without having to actively think about it. The app's "bills section" is particularly useful for those who want to set aside funds for fixed expenses without worrying about accidentally spending them. While some users have reported occasional issues with account disconnections or app crashes, many find that Oportun is a reliable tool for building savings and achieving financial stability.

Pros & Cons

- Simple and straightforward

- Great for saving for bills

- Auto save feature for goals

- Easy to set and forget

- App crashes frequently

- Poor customer support

- Frequent account disconnects

Why we chose it?

I love Oportun! It's super easy to set up and use, and I really appreciate that it learns my spending habits and automatically saves for me. Plus, it helps me manage my Oportun loan and credit card in one place, which is a huge time-saver. I'd definitely recommend it to anyone who wants to make saving money easier!

11. NerdWallet

Track spending across multiple cards, Get detailed spending insights

Download:

Application information

| Category | Finance |

| Downloads | Over 1.8 million downloads |

| Features | Track your budget, credit score, and net worth with personalized insights and tips to help you save money. |

| Who It’s For | People looking for an app to help them save money and manage their finances |

- Tags:

- Budget Tracking

- Expense Monitoring

- Credit Score Insights

NerdWallet, once a shining star in the personal finance app world, has unfortunately lost its luster. While it initially helped many users, including me, track spending, find the best credit cards, and manage their finances, its reliability has dwindled. The app frequently struggles to connect to accounts, dropping them completely, and fails to accurately track purchases, especially those related to bills and utilities. While the credit score feature remains functional, the inaccuracies and glitches in other areas render it far from a reliable and helpful tool for saving money. The outdated and cluttered interface only exacerbates the frustration, making NerdWallet a far cry from its former glory.

Pros & Cons

- Helps find best credit cards

- Tracks spending and budgeting

- Provides credit score monitoring

- Offers financial advice and tools

- Inaccurate account data and updates

- Limited account compatibility and linking

- Cluttered and confusing user interface

- Misleading information and unreliable data

Why we chose it?

Hey there, money-savvy friend! NerdWallet is your go-to for taking control of your finances. We've got you covered with budgeting tools, expense tracking, and personalized tips to help you save like a pro. Our intuitive interface and clear insights make it easy to see where your money is going and how to make it work harder for you.

12. Qapital

Round-up purchases to save, Automate savings for your goals, Invest spare change effortlessly

Download:

Application information

| Category | Finance |

| Downloads | Over 1 million downloads |

| Features | Qapital is an app that automates saving by rounding up purchases, creating rules to transfer money from your checking account to your savings account, and offering automated investing through their robo-advisor. |

| Who It’s For | People who want to save money automatically without having to manually transfer money or think about it. |

- Tags:

- Automatic savings

- Personalized goals

- Behavioral science

Qapital is a mobile app designed to help you save money without even thinking about it. It allows you to set up automatic saving rules, such as rounding up purchases to the nearest dollar or setting aside a small amount each day. This "set it and forget it" approach makes saving painless and allows you to reach your financial goals more easily. While some users have expressed frustration with inconsistencies in deposit frequency, the app's intuitive design and effective rounding-up feature have earned praise, and many users have seen significant savings in a short amount of time.

Pros & Cons

- Easy to use

- Automatic savings rules

- Roundup feature

- Spending account feature

- Opaque deposit frequency

- Charges for basic features

- Syncing issues with accounts

Why we chose it?

Qapital is my go-to for saving because it's super easy to set up automatic savings rules that actually stick! I love the "Round Ups" feature that rounds up my purchases and sends the spare change to my savings, and I've been able to reach my goals faster by just letting Qapital do its thing. It's definitely worth checking out if you want to make saving a habit!

13. Betterment Invest & Save Money

Automated investing with low fees, Personalized portfolio for your goals

Download:

Application information

| Category | Finance |

| Downloads | Over 885,000 downloads |

| Features | The app offers automated investing, goal-based savings, cash management, and retirement planning features, all managed by a robo-advisor. |

| Who It’s For | People who are looking for an easy and affordable way to save money and invest for the future. |

- Tags:

- Robo-advisor

- Personalized experience

- Low minimum investment

Betterment Invest & Save Money is a mobile app designed to help you manage your finances and reach your savings goals. While users praise its stability and functionality, they express frustration with the app's interface, particularly the confusing layout and multiple ways to perform the same task, like transferring funds between accounts. There are also concerns about security, with users noting that the app screen remains visible even after navigating away, potentially exposing sensitive information. Although the app offers appealing features like no-fee checking and cash-reserve accounts, the difficulty in linking external accounts and transferring funds hinders the overall user experience. Despite these shortcomings, Betterment remains a popular choice for those seeking an app to help them save money, but improvements are needed to make the experience more user-friendly and secure.

Pros & Cons

- Easy to use interface

- Stable and reliable app

- No fee checking accounts

- Cash-reserve accounts available

- Confusing and cluttered layout

- Difficult to transfer funds

- Linking external accounts is hard

Why we chose it?

Betterment is a great choice for saving money because it takes the guesswork out of investing! With its robo-advisor technology, you can set and forget your savings goals while diversifying your portfolio automatically. Plus, with no minimum balance required, it's easy to get started and start growing your money.

14. Savings Goal

Unlimited goal creation, Track savings progress, Calculate required savings

Cost:

Free (Free), Premium ($4.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 628,000 downloads |

| Features | Create unlimited savings goals with images, set target dates, track progress, and calculate daily, weekly, and monthly savings needed. |

| Who It’s For | Anyone looking for an app to help them save money and reach their financial goals. |

- Tags:

- Goal Tracking

- Savings Planner

- Progress Visualization

"Savings Goal" is a simple yet powerful app for saving money that helps you achieve your financial dreams. The app allows you to create unlimited goals, add motivating images, and set target dates. It then calculates the minimum amount you need to save each month, week, or day to ensure you reach your goals on time. Users praise its clean design and intuitive interface, making it easy to track your progress and stay motivated. With its ability to organize goals, add pictures, and even provide detailed weekly savings breakdowns, "Savings Goal" offers a comprehensive and user-friendly approach to achieving your financial aspirations.

Pros & Cons

- Simple and easy to use

- Free with premium option

- Clean and simple interface

- Adds pictures to goals

- Can't organize goals

- Dashboard information layout

- No category separation

Why we chose it?

Hey, I'm the creator of Savings Goal and I'm super proud of how simple yet powerful it is! It lets you set any savings goal you dream of, track your progress effortlessly, and calculates exactly how much to save each day, week, or month to make it happen. This app is perfect for anyone who wants to turn their saving dreams into a reality!

15. Savings Tracker

Set goals and track progress, Receive regular saving reminders

Download:

Application information

| Category | Finance |

| Downloads | Over 169,000 downloads |

| Features | Track your savings, set financial goals, receive reminders to save regularly, and visualize your progress towards achieving financial freedom. |

| Who It’s For | Anyone looking for a simple yet effective app for saving money. |

- Tags:

- Easy Money Tracking

- Reminders to Save

- Simple Financial Planner

Savings Tracker is a visually appealing and intuitive app for saving money that helps you visualize your financial goals and track your progress. Users rave about its ease of use, enjoyable design, and helpful features like percentage-based progress tracking. One reviewer even paid to support the app, calling it "perfect." This app's focus on clear visualization and user-friendly design makes saving money feel engaging and achievable.

Pros & Cons

- Visualizes future savings goals

- Easy to use, helpful features

- Gorgeous design, enjoyable saving

- Shows progress in percentages

- Limited goal customization options

- No option to add notes to goals

- Limited goal sorting options

Why we chose it?

I love Savings Tracker because it's super simple to use and helps me stay focused on my savings goals. The daily reminders keep me accountable, and I find it really motivating to see my progress towards my targets. It's a great app for anyone who wants to take control of their finances and build a healthy savings habit!

16. SavePal

Track savings progress towards goals, Visualize savings history with charts

Cost:

Free (Free), Premium ($4.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 156,000 downloads |

| Features | SavePal helps you set saving goals, track your progress, and stay motivated to reach your financial targets. |

| Who It’s For | Anyone who wants to save money and achieve their financial goals. |

- Tags:

- Easy savings tracking

- Unlimited savings goals

- Progress Visualization

SavePal is a simple and effective app for saving money that helps you stay organized and motivated to reach your financial goals. With SavePal, you can create categories for different savings targets, track your progress, and easily visualize how close you are to achieving your dreams. Users love its intuitive design and appreciate the ability to manage their savings goals with ease. While some users would appreciate the ability to adjust their savings, SavePal offers a convenient way to keep track of your finances and stay on top of your savings journey.

Pros & Cons

- Simple and easy to use

- Organizes savings goals by category

- Keeps track of savings progress

- Clear settings and options

- Can't remove money from savings

- No total remaining for all goals

- Limited theme color options

Why we chose it?

I love SavePal because it's super easy to use, and helps me stay motivated to reach my savings goals. It lets me track my progress with charts and graphs, so I can see exactly how much I'm saving and where my money is going. Plus, it's completely free, so I don't have to worry about any hidden fees.

17. Monarch

Track spending and income, Set budgets and goals, Analyze spending patterns

Cost:

Free (Free), Monarch Plus ($14.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 100,000 |

| Features | Monarch helps you track spending, budget, save, and invest, all in one easy-to-use app. |

| Who It’s For | Individuals seeking an app for saving money and improving their financial health. |

- Tags:

- Budgeting Made Easy

- Personalized Money Management

- Achieve Financial Goals

Monarch is a powerful app for saving money that promises to help you achieve your financial goals, but it's not without its quirks. While users praise its features like budgeting tools and tracking progress, they also highlight recurring issues with connectivity and bugs. Some have even found the app's design clunky and difficult to use, particularly on Android devices. Despite these drawbacks, many consider Monarch to be the best alternative to Mint for those seeking a more comprehensive financial management solution.

Pros & Cons

- Best Mint replacement

- Tracks spending, net worth

- Helps achieve financial goals

- Functional when working properly

- Buggy and unreliable app

- Poor login experience on Android

- Recurring expense detection issues

Why we chose it?

I'm a big fan of Monarch! It's helped me get a handle on my spending and actually stick to my budget. I love that it automatically categorizes my transactions and gives me personalized insights into where my money is going. Plus, the goal-setting feature is super motivating – I'm finally on track to save for that dream vacation!

18. JamJars

Visualize savings growth over time, Track transactions and progress easily

Cost:

Free (Free), JamJars Premium ($4.99/month)

Download:

Application information

| Category | Finance |

| Downloads | Over 100,000 downloads |

| Features | JamJars allows you to create virtual 'jars' for specific savings goals, track progress, manage debts, and collaborate with others in real-time. |

| Who It’s For | Anyone looking for a simple and effective app to help them save money and achieve their financial goals. |

- Tags:

- Real-time collaboration

- Debt tracking

- Visual progress tracking

JamJars is a delightful app for saving money that makes reaching your financial goals fun and visually engaging. Its simple, cute design, complete with animated jar waves that rise as you progress, keeps you motivated and helps you visualize your savings journey. The app offers flexible sorting options, making it perfect for tracking multiple saving challenges or goals simultaneously, while its intuitive interface allows for easy updates and tracking of your progress. Whether you're just starting out or are a seasoned saver, JamJars provides a visually appealing and effective way to manage your money and achieve your financial aspirations.

Pros & Cons

- Cute design helps save

- Visualizations motivate saving

- Easy to track savings

- Good for multiple challenges

- Widgets need improvement

- Color shades limited

- No information on jar limit

Why we chose it?

JamJars is my go-to app for saving money because it's super easy to use and visually appealing. I love the "jars" feature, where I can allocate money to specific goals like a vacation or a new laptop, and track my progress in real-time. It's also great for collaborating with my partner so we can work together towards our financial goals, which makes saving money much more fun and effective!